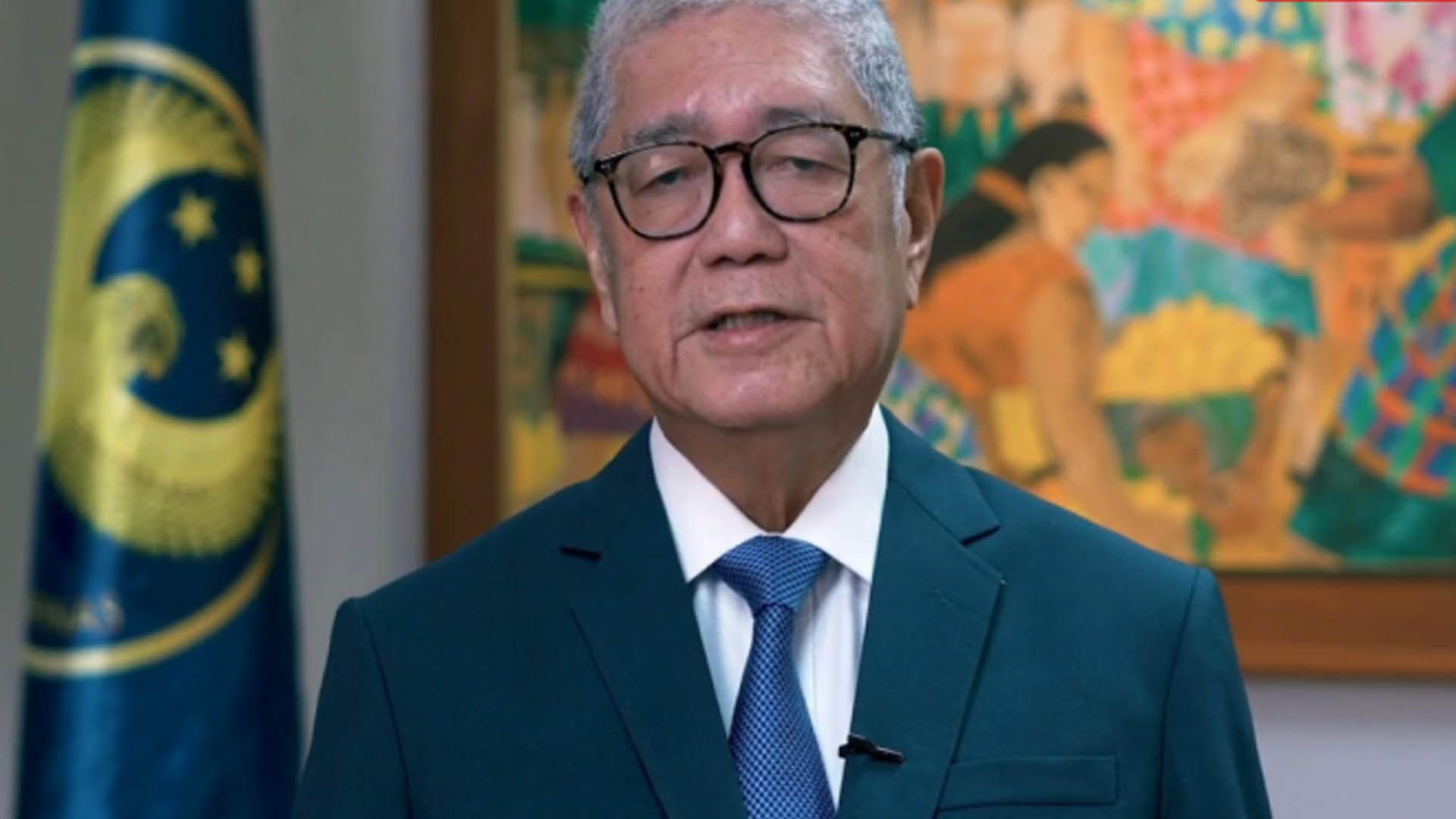

Despite the uptick in headline inflation in August, Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. on Thursday said there is no need to raise interest rates if there are no further supply shocks.

“If it’s just an uptick, food prices and oil caused the uptick, these kinds of supply shocks, they dissipate usually very quickly,” Remolona said during a briefing at the sidelines of the 2023 Alliance for Financial Inclusion (AFI) Global Policy Forum at the Philippine International Convention Center, Pasay City.

“So, if that’s all there is, if there are no further supply shocks beyond that uptick in August, then it won’t be necessary to hike the policy rates,” he said.

Headline inflation picked up to 5.3 percent in August due to higher inflation of food and non-alcoholic beverages.

The BSP has an inflation target of 2 to 4 percent.

“As you know we’re really, really serious about price stability. In deciding on what to do with the policy rate, we look at whether we’re comfortable with the target range,” the BSP chief said.

“So far, we’ve been hit by what we call supply shocks. The supply shocks are especially harmful to the poor. That’s the main reason why we have (a) price stability objective. We’re really, really committed to achieving that objective,” he said.

Remolona said if there are no more supply shocks, the inflation target range could be hit by October.

During its last policy meeting on August 17, the BSP’s Monetary Board kept policy rates unchanged.

The BSP’s overnight reverse repurchase facility remained at 6.25 percent, overnight deposit rate at 5.75 percent, and overnight lending rate at 6.75 percent.

The Monetary Board is scheduled to have its next policy meeting on September 21, 2023. (PNA)